Partnerships Impacting Generations

For nearly 35 years, OCCH has relied on partnerships to ensure housing opportunities are available for future generations and for decades ahead.

35 Years of Partnerships & Impact

Total Equity Investment

Affordable Housing Units

Developments

Foreclosures

Equity Raised

Development Projects Closed

Invested

Affordable Housing Investment

With a deep understanding of market changes, OCCH is the innovative resource that investors trust to deliver results. OCCH’s legacy is that of honoring long-term partnerships, welcoming new relationships and expanding investment opportunities, to provide the capital to build, change, and revitalize communities.

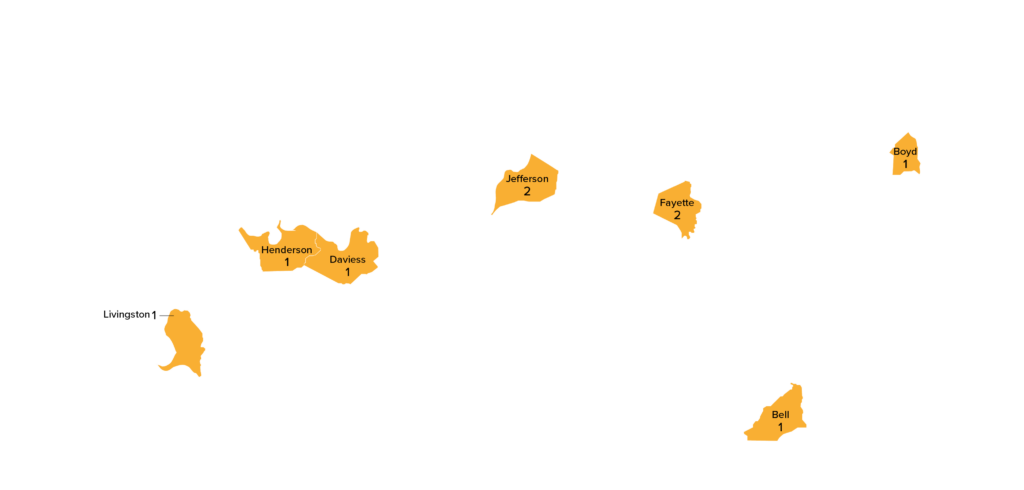

Our Portfolio

OCCH’s portfolio consists of over 61,000 units throughout six states. OCCH’s regional focus has allowed it to be an industry advocate and a trusted resource to developers and investors.

Ohio

Stabilized

Leasing / Construction

Kentucky

Stabilized

Leasing / Construction

Indiana

Stabilized

Leasing / Construction

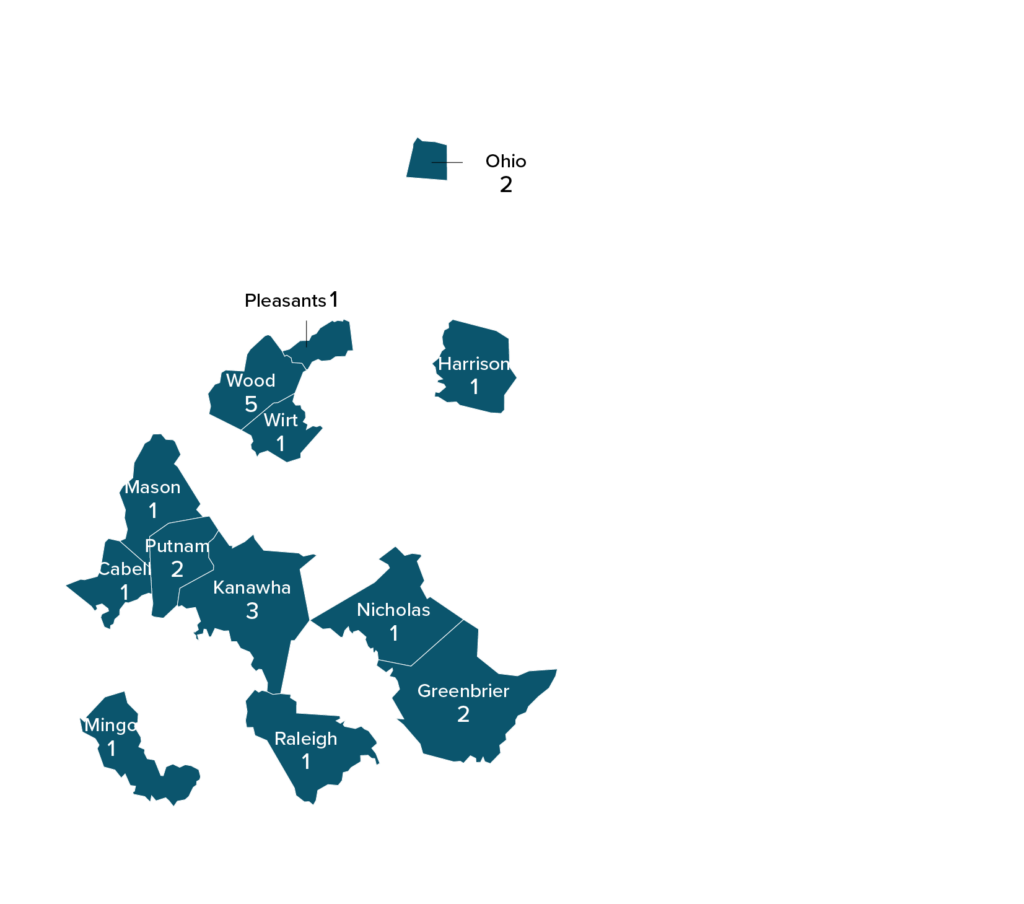

West Virginia

Stabilized

Leasing / Construction

Pennsylvania

Stabilized

Leasing / Construction

Tennessee

Stabilized

Leasing / Construction

Featured Developments

Slater Hall

Cincinnati, OH

Developers: Tender Mercies & Over-the-Rhine Community Housing

Fund: OEF 5/3 Fund VII

Slater Hall is a new Permanent Supportive Housing development in Cincinnati’s historic West End neighborhood. Co-developed by Tender Mercies & Over-the-Rhine Community Housing, this 62-unit community features efficiency style apartments, individual bathrooms, on-site laundry facilities, and enhanced safety features.

Slater Hall is named after Ed Slater, who in 1985, was instrumental in founding Tender Mercies. This community recognizes the legacy and impact of Mr. Slater who championed the rights of people experiencing homelessness.

OCCH financed Slater Hall via an investment from OEF 5/3 Fund VII, a proprietary fund with Fifth Third CDC.

Harriet’s Hope

Columbus, OH

Developers: Columbus MHA & Beacon360

Fund: AETNA Fund XX

Harriet’s Hope is a new construction 52-unit development providing housing to survivors of human trafficking in Columbus, Ohio. The community consists of 47 one-bedroom units and five two-bedroom units in a single, three-story, controlled-access building with elevators, interior corridors, and community spaces.

Harriet’s Hope is a first-of-its-kind development in Columbus and is among one of the nation’s first communities providing services specifically for survivors of human trafficking. Supportive services offered at Harriet’s Hope include holistic and trauma-informed behavioral, mental, and physical health services.

OCCH financed the development via an investment from AETNA Fund XX, a proprietary investment fund with CVS/Aetna, and a grant from Ohio Capital Impact Corporation.

Kearney Ridge

Lexington, KY

Developers: AU Associates

Fund: OEF XXXI

Kearney Ridge is a 252-unit new construction development located in Lexington, Kentucky. Developed and managed by AU Associates, this community is comprised of 96-one bedroom, 96 two-bedroom and 60 three-bedroom units serving low-income family households. Residents have access to a pool, community center, and fitness center amenities.

OCCH financed the development via an investment from OEF XXXI, a multi-investor fund.

Wade Park

Cleveland, OH

Developers: Cuyahoga MHA

Fund: OEF 32B & OEF XXXI

Located in Cleveland, Ohio, Wade Park Apartments is a 229-unit rehabilitation (RAD) development. Professionally managed by Cuyahoga MHA, this community is comprised of 190 one-bedroom, and 39 two-bedroom LIHTC/PBV units serving low-income family households.

Community features include a community room with wi-fi, computer lab, patio area with seating, shared balconies, and laundry facilities. Residents can enjoy walking through the Cleveland Cultural Gardens nearby as well as the Wade Oval which hosts community events throughout the summer months. Additional nearby attractions include University Circle, the Cleveland Museum of Natural History, the Cleveland Botanical Garden, and the Cleveland Museum of Art.

OCCH financed the development via an investment from OEF 32B and OEF XXI, two multi-investor funds.

Norris Gardens Apartments

Norris, TN

Developers: AAMCI Development

Fund: OEF 32A

Norris Gardens Apartments is a 51-unit rehabilitation property located in Norris, Tennessee. Developed by AAMCI, this development is comprised of 50 one-bedroom homes serving low-income elderly households and one two-bedroom market rate unit.

OCCH financed this development via an investment from OEF 32A, a multi-investor fund.

Josephs Crossing

Summersville, WV

Developers: Woda Group

Fund: OEF XXXI

Located in Summersville, West Virginia, Josephs Crossing is a 42-unit rehab development consisting of eight one-bedroom, 22 two-bedroom, and 12 three-bedroom apartments. Developed and managed by Woda Group, Josephs Crossing will provide housing to low-income families and households.

Residents at Josephs Crossing can enjoy spacious apartments which include energy efficient electric appliances, washer/dryer hookups, and extra storage. The community features a laundry facility, clubhouse, and playground.

OCCH financed the development via an investment from OEF XXXI, and the development was also awarded a Huntington Digital Inclusion Grant via OCIC.

Chestnut Village Apartments

Ashtabula, OH

Developers: Neighborhood Development Services, Inc.

Fund: OEF 33A

Chestnut Village Apartments is a two-story, 32 one-bedroom senior living community in Ashtabula, Ohio. The three-acre parcel in a residential neighborhood of Ashtabula, was once the location of an elementary school that was demolished years ago.

Residents at Chestnut Village have access to a community room with kitchenette, laundry facilities, a fitness room, and a library/game room. Resident supportive services include assistance with enrollment for senior services (meals, homemaker services, utility assistance, etc.), coordination of wellness services, counseling services, job training and/or placement services, and connections to resources and information based on residents’ needs.

OCCH financed the development via an investment from OEF 33A, a multi-investor fund.