Ohio Capital Finance Corporation

Ohio Capital Finance Corporation continued its twenty-year path of providing additional capital to aid in the development of affordable housing.

A complete look at the work OCFC has done during its tenure can be found in a comprehensive report here.

Loans

Units

Total lending

Counties across 3 states

2023 Loan Production by Loan Type

Hover over the pie chart for more details.

Equity bridge

Construction

Pre-development

Permanent

Other

Acquisition

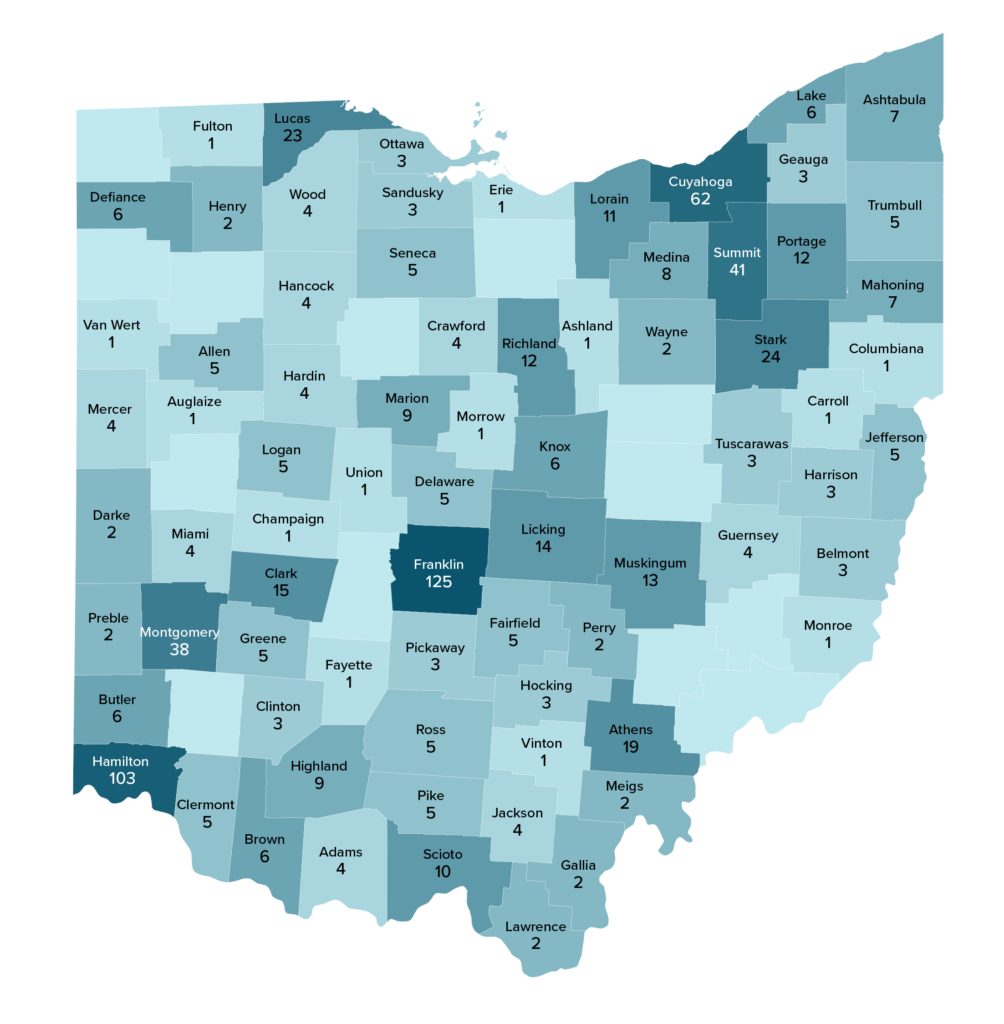

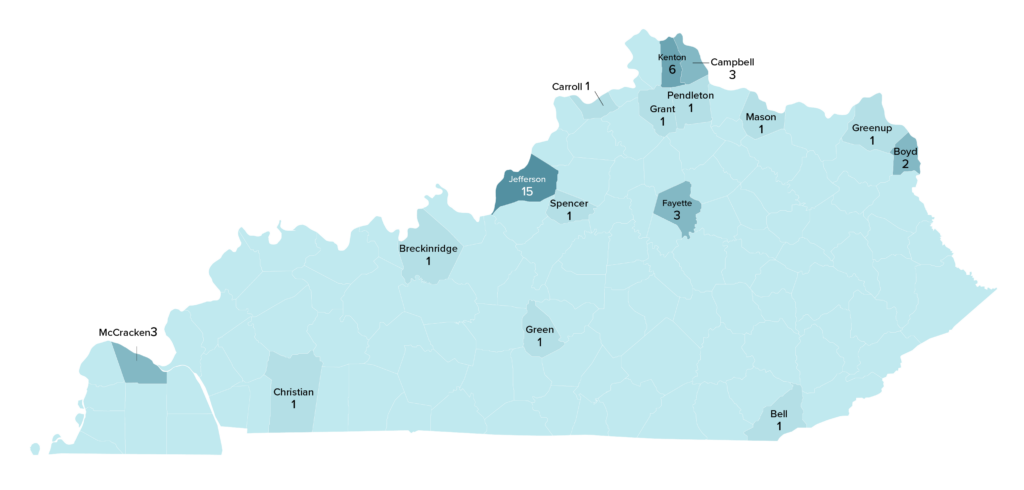

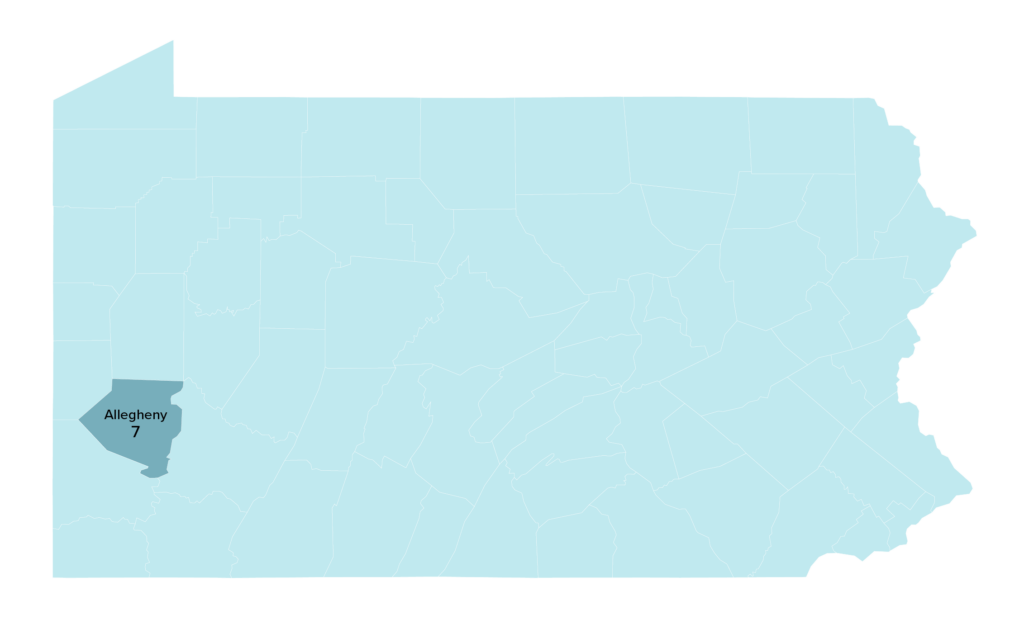

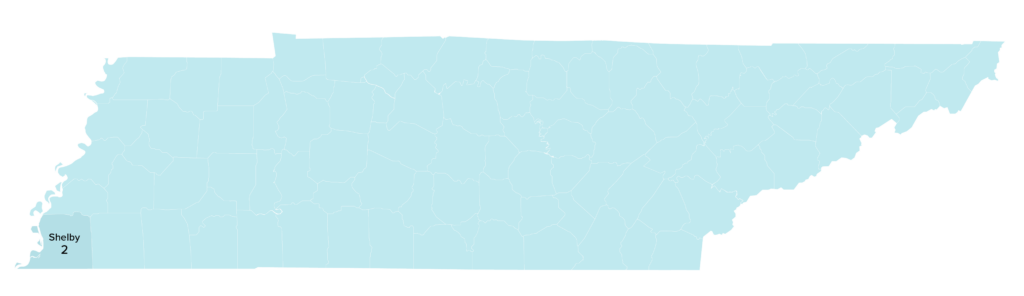

Loans by County

OCFC has provided loans in 99 counties across 5 states.

Ohio

Kentucky

West Virginia

Pennsylvania

Tennessee

OCFC Partners

OCFC is pleased to recognize the following lenders and investors that allow OCFC to provide the creative financing tools necessary to sustain and produce affordable housing and expand its community development impact.

2023 Accomplishments & Initiatives

In 2023, OCFC closed $50 million in the Linden Healthy Homes Fund II, deployed $3 million of OCFC’s Equitable Recovery Program award, and made comprehensive updates to its policies and procedures. Below is a complete overview of each accomplishment and initiative.

Linden Healthy Homes Fund II

With the success of the first Linden Healthy Homes Fund and the ever increasing need to increase the supply of affordable housing in Columbus, Nationwide Children’s Hospital, Community Development for all People and their joint venture nonprofit affordable housing affiliate, Healthy Homes, sought to develop a second phase to create an additional 150 units of affordable housing in Linden. Phase II continues the momentum of Phase I and includes a majority of new construction 3-bedroom units located within single family and duplex structures with rents affordable to residents at incomes of 80% of AMI or below. Modeled upon the success of the Southside Renaissance Fund, and after consultation with the banking community, a $50 million capital stack was developed. The fund is comprised of $23.4 million of financial institution and CDFI debt capital and $26.6 million of grants and equity provided by private philanthropic funding and equity from Nationwide Children’s Hospital and the City of Columbus. The Linden Healthy Homes Fund II allows Healthy Homes to expand its mission and increase the supply of affordable housing by 150 units and continue creating economic and neighborhood transformation. As of year-end, 30 units were complete and occupied. Additionally, the fund received positive press from Columbus Business First and the Columbus Dispatch.

Equitable Recovery Program funding for 65 Nickel

OCFC received a $3,500,000 grant from the CDFI Fund’s Equitable Recovery Program (ERP) in 2023. The ERP is designed to provide funding to CDFIs to expand lending, grant making and investment activities in low- or moderate-income communities that have experienced disproportionate economic impacts from the COVID-19 pandemic. OCFC quickly deployed its award as below-market financing for 65 Nickel, an affordable housing development in Akron, Ohio. 65 Nickel is located in an area that was identified as having experienced severe impact from the COVID-19 pandemic, as well as being a majority-minority Census tract, where more than half of the population self-identifies as a member of one or more racial or ethnic minority populations. OCFC partnered with Spire Development to create 43 new units affordable housing for families with incomes ranging between 30% - 80% of the area median income.

Policies and Procedures

With the addition of three new staff members to OCFC and the expansion of programs in 2023, OCFC took the opportunity to focus on revising its policies and procedures to bolster its capacity for future growth. With the assistance of a professional consultant, OCFC undertook a comprehensive update to the two documents, revising them to reflect industry best practices to provide the foundation for OCFC’s continued expansion. The document was formally approved by OCFC’s Board of Directors in February 2024. In future years, the OCFC team will continue to consider revisions in response to evolving market conditions, legal context, or other needs of OCFC’s staff, Board, affiliated loan funds, and borrowers.

OCFC Team

OCFC’s team is comprised of experts in the areas of lending, housing, grant writing, and administration. These professionals remain committed to enabling affordable housing developments through lending activities.

Jonathan Welty

Executive Vice President of OCCH, President of Ohio Capital Finance Corporation

Diane Alecusan

Director of Grants and CDFI Compliance

Ashley Castricone

Closing Officer

Aaron Murphy

Vice President

Ryan Schmitt

Underwriting Officer

Jodi Stickel

Operations/Portfolio Administrator